Taxes are a responsibility, but they don’t have to be an adversary. Our guidance seeks to optimize your strategies by minimizing your liabilities, freeing up your wealth to work more efficiently for you.

TAX MITIGATION PLANNING | TAX-EFFICIENT DISTRIBUTION PLANNING | TAX-EFFICIENT PORTFOLIO MANAGEMENT

KEEP MORE OF WHAT YOU EARN

Our firm offers technical expertise alongside third-party professionals in tax mitigation strategies, and alternative investments, within a holistic, multi-family office approach to planning for your financial independence. We partner with you to navigate the complexities of the tax code and develop a personalized plan that maximizes your after-tax returns.

TAX MITIGATION PLANNING

Our team of experts will identify tax-efficient investments, develop tax-advantaged retirement savings plans, and create charitable gifting strategies that benefit both you and your community. We combine a deep understanding of the tax code with sophisticated financial planning techniques to help you minimize your tax burden and keep more of your hard-earned money.

TAX-EFFICIENT DISTRIBUTION PLANNING

Creating a tax-efficient distribution plan is crucial for a comprehensive financial strategy. At Aurelius, we offer a range of services to help you maximize your wealth and minimize your tax burden. Our experienced advisors provide guidance on sophisticated structures that have the potential to significantly reduce your income tax liability while optimizing your investments. With anticipated tax rate increases in 2026, we possess the technical expertise and foresight to help you navigate the future of your retirement with confidence. By taking a thoughtful approach to retirement planning, we ensure that you can enjoy the retirement lifestyle you deserve.

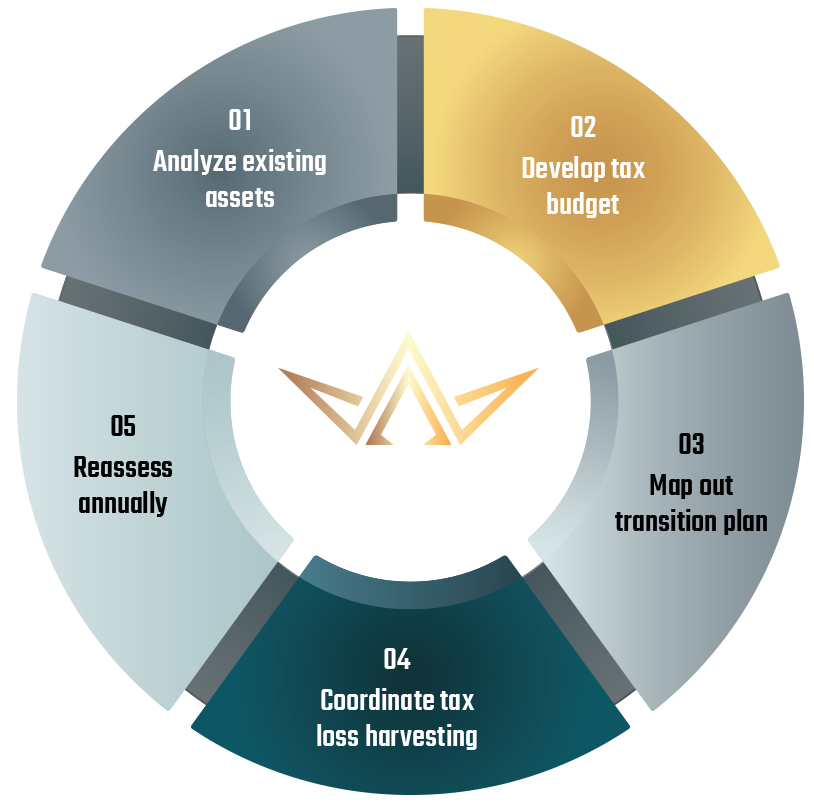

TAX-EFFICIENT PORTFOLIO MANAGEMENT

Effective tax planning extends beyond tax season. Our tax-efficient portfolio management strategies can help you achieve your long-term financial objectives by minimizing your tax liability throughout the year. We work with you to develop an investment strategy that aligns with your goals and risk tolerance while minimizing the tax impact of your investments. By using tax-efficient investment vehicles and strategies such as tax-loss harvesting, we can help you keep more of your returns and achieve your financial objectives.

MAKE THE MOST OF YOUR WEALTH

Our recommendations are outcome-based, not tax-driven. We work to develop a tax plan that aligns with your unique financial objectives, taking into account various tax obligations, including annual income and capital gains taxes, as well as inheritance and estate taxes both now and in the future. Ready to talk about efficient tax planning?

LA

1925 Century Park E, Suite 1700

Los Angeles, CA 90067

NYC

2 Park Avenue, Suite 300,

New York, NY 10016

SOFL

2600 N. Military Trail, Suite 420,

Boca Raton, FL 33431